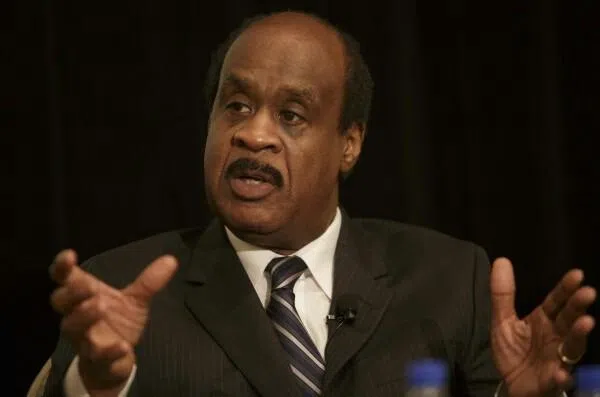

INTERVIEW – Montgomery County Executive IKE LEGGETT

>> FLASHBACK: MARCH 14TH: Leggett Proposes Property Tax Increase In Bid to Increase Education Spending. In his recommended $5.27 billion fiscal year 2017 operating budget, Leggett called for a property tax increase of 3.94 cents per $100 of assessed value, a new rate that would go into effect July 1 and that would cost the average county homeowner about $27 more per month. The average home value in Montgomery County is about $460,000. The 8.6 percent tax increase surpasses the maximum rate allowed under the county’s charter, meaning it could require support from all nine members of the County Council for final approval.

>> BREAKING NEWS: LEGGETT TO COUNCIL: REDUCE PROPOSED PROPERTY TAX INCREASE. County Executive Ike Leggett today amended his 2017 budget to the County Council to reduce his proposed property tax increase by 46 percent following the announcement by Governor Hogan that he will allow to become law a Maryland General Assembly bill that extends the repayment schedule for counties to comply with the US Supreme Court’s Wynne decision.

“My initial proposed operating budget includes $50 million to cover Wynne case costs,” said Leggett. “I promised our State Delegation that if they passed legislation that would extend the back payments to the State I would reduce my property tax increase request. They have delivered, I have amended my proposed budget to reflect the savings from that legislation, and I recommend to the Council that reduction. The timing of credits to the affected taxpayers will not be delayed.

“I want to thank the sponsors of the bill, Senators Rich Madaleno and Cheryl Kagan, and all the other members of our State delegation who worked hard to ensure passage of this legislation.”

The legislation, Senate Bill 766, saves Montgomery County $33 million for the upcoming year, reducing the Wynne costs to $17 million. Reducing the property tax increase from 3.9 cents per $100 assessed valuation to 2.1 cents – a 46 percent reduction — brings the County Executive’s proposed average monthly property tax increase down from $27 to $18.67.